SAN FRANCISCO--(BUSINESS WIRE)--Apr 17, 2025, 1:40pm ET--SoFi Technologies, Inc. (NASDAQ: SOFI) announced a $2 billion extension of its Loan Platform Business agreement for personal loans with funds managed by affiliates of Fortress Investment Group (“Fortress”). This extension builds on the original $2 billion Loan Platform Business agreement between SoFi and Fortress announced in October 2024.

SoFi Technologies, Inc. announced a $2 billion extension of its Loan Platform Business agreement for personal loans with funds managed by affiliates of Fortress Investment Group (“Fortress”).

The total commitment provided by Fortress for SoFi’s Loan Platform Business has now reached over $5 billion.

"Our continued collaboration with Fortress is a testament to the success, strength and scalability of our Loan Platform Business," said Anthony Noto, CEO of SoFi. "The additional $3.2 billion commitment helps us better meet borrower demand for personal loans while moving SoFi towards less capital-intensive and more fee-based sources of revenue. We’re building strong momentum for our Loan Platform Business in 2025 and beyond."

"The extension of our partnership with SoFi is a reflection of our confidence in the company’s consumer loan product offerings to their members through their Loan Platform Business," said Dominick Ruggiero, Global Co-Head of Asset Based Credit at Fortress. "We are excited to expand this mutually beneficial partnership that helps increase the availability of personal loans for consumers and creates a compelling investment opportunity for Fortress’s funds."

SoFi’s Loan Platform Business refers pre-qualified borrowers to loan origination partners as well as originates loans on behalf of third parties.

About SoFi

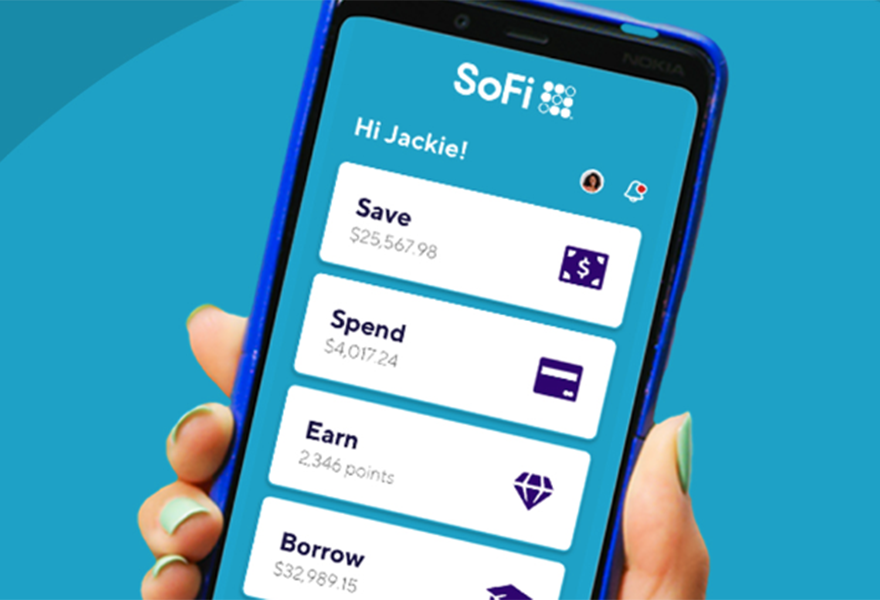

SoFi (NASDAQ: SOFI) is a member-centric, one-stop shop for digital financial services on a mission to help people achieve financial independence to realize their ambitions. The company’s full suite of financial products and services helps its over 10.1 million SoFi members borrow, save, spend, invest, and protect their money better by giving them fast access to the tools they need to get their money right, all in one app. SoFi also equips members with the resources they need to get ahead – like credentialed financial planners, exclusive experiences and events, and a thriving community – on their path to financial independence.

SoFi innovates across three business segments: Lending, Financial Services – which includes SoFi Checking and Savings, SoFi Invest, SoFi Credit Card, SoFi Protect, and SoFi Insights – and Technology Platform, which offers the only end-to-end vertically integrated financial technology stack. SoFi Bank, N.A., an affiliate of SoFi, is a nationally chartered bank, regulated by the OCC and FDIC and SoFi is a bank holding company regulated by the Federal Reserve. The company is also the naming rights partner of SoFi Stadium, home of the Los Angeles Chargers and the Los Angeles Rams. For more information, visit SoFi.com or download our iOS and Android apps.

©2025 SoFi Technologies, Inc. All rights reserved.

About Fortress Investment Group

Fortress Investment Group LLC is a leading, highly diversified global investment manager. Founded in 1998, Fortress manages $50 billion of assets under management as of December 31, 2024, on behalf of approximately 2,000 institutional clients and private investors worldwide across a range of credit and real estate, private equity and permanent capital investment strategies. For more information, visit Fortress.com.

The Fortress Asset-Based Credit business provides capital solutions to specialty finance companies, lending against and investing in a broad spectrum of consumer receivables, small commercial receivables and other contractual cash flow streams. With over two decades of experience as an active investor in the space, the team focuses primarily on originating businesses in the US and Europe with an asset class agnostic approach.

AUM refers to assets Fortress manages, including capital that Fortress has the right to call from investors, or investors are otherwise required to contribute, pursuant to their capital commitments to various funds or managed accounts.

About Edge Focus

Edge Focus is a technology-driven investment firm that delivers Curated Access to Consumer-Focused Private Credit—with Edge. Through its proprietary platforms, Origin and Lens, Edge Focus manages funds, SPVs, and SMAs, while also powering fintech partners with advanced underwriting and portfolio analytics tools. Learn more at www.edgefocuspartners.com.

Availability of Other Information About SoFi

Investors and others should note that we communicate with our investors and the public using our website (https://www.sofi.com), the investor relations website (https://investors.sofi.com), and on social media (X and LinkedIn), including but not limited to investor presentations and investor fact sheets, Securities and Exchange Commission filings, press releases, public conference calls and webcasts. The information that SoFi posts on these channels and websites could be deemed to be material information. As a result, SoFi encourages investors, the media, and others interested in SoFi to review the information that is posted on these channels, including the investor relations website, on a regular basis. This list of channels may be updated from time to time on SoFi’s investor relations website and may include additional social media channels. The contents of SoFi’s website or these channels, or any other website that may be accessed from its website or these channels, shall not be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended.

Media Contacts

SoFi: PR@sofi.org

Fortress Investment Group: mlane@fortress.com