European Non-Performing Loans

The Fortress European NPL team consists of 21 dedicated professionals* and has a proven track record in investing in pools of NPLs with a focus on loans secured by real estate or backed by personal or corporate guarantees together with other opportunities linked to NPL situations. We believe our 20+ years of on-the-ground experience in originating, acquiring and servicing debt investments uniquely positions Fortress to source, underwrite and manage large highly diversified NPL pools and distressed single-name loans with the goal of delivering attractive risk-adjusted returns.

*As of March 31, 2024.

As of March 31, 2024.

Fortress Approach

"Our experience and discipline in pricing opportunities, combined with rigorous and methodical asset management, has uniquely positioned us as a long-term investor throughout European banking cycles."

Francesco Colasanti & Christopher Linkas

Co-Heads of the Fortress European NPL Business

Key Differentiators

Seasoned and On-The-Ground Investment Team

Senior investment team averages approximately 25 years of sector experience with an average tenure at Fortress of 20 years, offering a deep industry network and numerous strategic partnerships with top European banks

Established Servicing Partner

We have a strategic partnership with doValue S.p.A.*, the leading independent loan servicing business in Southern Europe with offices in Italy, Spain, Greece, Portugal and Cyprus

Strong Deal Flow

Fortress’ long history of NPL investing has led to a strong reputation in the banking sector as a reliable execution partner with unique access to opportunities

Proprietary Data

Over two decades of collection curves and borrower payment behavior allow us to underwrite portfolios using best-in-class data analytics

Owned Portfolios

With approximately €62.5 billion GBV of NPL loans acquired since 2000**, we have been able to capture real estate trends and changes in payment behavior promptly in order to proactively adjust asset management strategy and modify underwriting assumptions

Experienced Asset Management

The NPL Team utilizes proprietary collection curves and actual local recovery experience to identify, structure, and proactively asset manage NPL opportunities in our target markets

Fortress Platform

The NPL Team draws on Fortress' experience in distressed debt investing, opportunistic lending, structured credits, corporate securities and structured finance to identify compelling risk-adjusted investments

* Fortress acquired doValue in 2015 and took it public in 2017. Fortress currently owns approximately 29% of doValue.

** As of March 31, 2024.

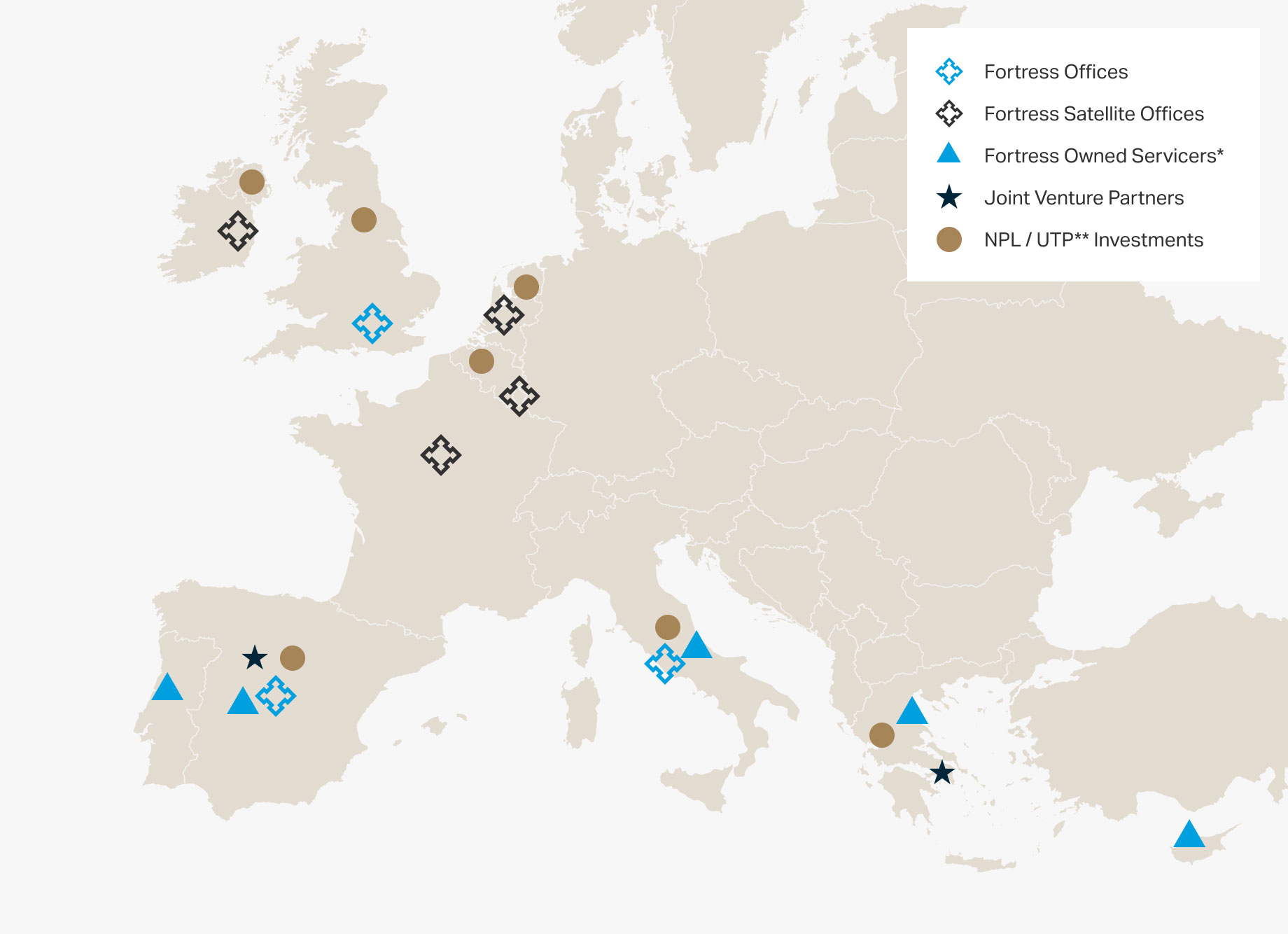

Fortress European NPL Footprint

As of December 31, 2023. Includes satellite Fortress offices in Ireland, France, Netherlands and Luxemburg.

* Certain servicers are owned by affiliates of Fortress, operate on a stand-alone basis, and are independently capitalized and managed. Includes servicers in which Fortress holds a minority, non-controlling equity interest, warrants or convertible debt interest. As a result, these companies are subject to potential divestment and there can be no assurance that any of these servicers will remain a Fortress affiliate or continue to be owned by Fortress.

** UTP refers to unlikely-to-pay loans.

Case Study

Project Neptune

Due to the Covid-19 pandemic, Greek courts were largely closed or operating at a limited capacity, so we implemented a dynamic asset management approach by focusing on out-of-court resolutions on larger exposures. We also transferred servicing of half of the pool to doValue to increase servicing effort and competition.

Once the courts reopened in 2022, we worked through a backlog of auctions and implemented a real estate operating company to participate and drive competitive pricing at auctions.

Real Estate Specialties